Order checks online with Chase Bank

How do I order checks online with Chase Bank? We all know that ordering a check is not as easy as filling out an application form and saying “pay me.” The whole process of receiving, loading, and paying for a check requires the consumer to have bank account number, date of birth, name, and social security number. If you don’t have all of these things in order, your check may not get to you in a timely manner.

There are several options available to those who need to get money quickly. One option is to use the U.S. Mail. This can be very convenient but also leads to problems if there is a problem with the delivery. Often, you may get an envelope that was addressed to the recipient but was returned because the recipient didn’t get the letter or the address was incorrect. This inconvenience leads many consumers to choose to order checks through the Internet. However, getting a check from Chase is an even better option.

You can order a check with the help of online banking tools that will give you the option of choosing which bank you want to use to send your check to. If you are concerned about being able to track down your check in the event of an error, you will find that this option is very convenient. The amount of time it takes to order a Chase bank check online depends on the type of payment you intend to make. In addition, the amount of time it takes to post the check to your account depends on how often the check is sent and received.

How Do I Order Checks Online? – Order checks online with Chase Bank?

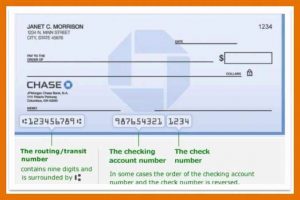

You will also find that there are different ways in which you can get your check into your bank account. If you use the Internet to order a check, you will likely use either a link on the Web site that will take you to a clearinghouse or you will use an automated clearinghouse service that does all of the work for you. Once you select which bank to use to send your check, you will fill out your personal information and write the routing number that will be used to send the check. You will also write the bank name and number that you wish to have written on your check. When you click “submit” on the toolbar, you will be given the option of either posting your check to your account immediately or you can give the check to the bank employee to pick up. If you are not home when your bank picks up the check, you will probably receive a courtesy call from the bank within a few hours.

If you use a clearinghouse to order a check, you will likely get your check into your bank account on the same day that you placed the order. When your check arrives, you should make sure to sign it in front of you and keep a copy of the signature for your records. The bank employee will then add your checks amount, date of issuance to your bank account. You may be required to sign a separate authorization form before your check is processed and shipped to you. This form will let you know how much money you have paid into your Chase account and any fees that you may have incurred. Some banks also allow you to order checks online.

How do I order checks online? When you go to the website for Chase Bank, you will be asked to select the type of check that you want to order. Choose the check type, which will be pre-determined, and choose your banking address, and then follow the simple directions provided. Once you have filled out your online form and submitted it, your check will be processed and shipped directly to you. It usually takes about 7 days for your check to arrive in your bank account.